FINANCIAL PROFESSIONALS ONLY

U.S. Small-Cap Market Overview

December 31, 2025

Table of Contents

5Year-to-Date Small-Cap Overview as of 12/31/25

64Q25 Sector and Industry Review

7Year-to-Date Sector and Industry Review

8Small-Cap Recoveries Since 1945

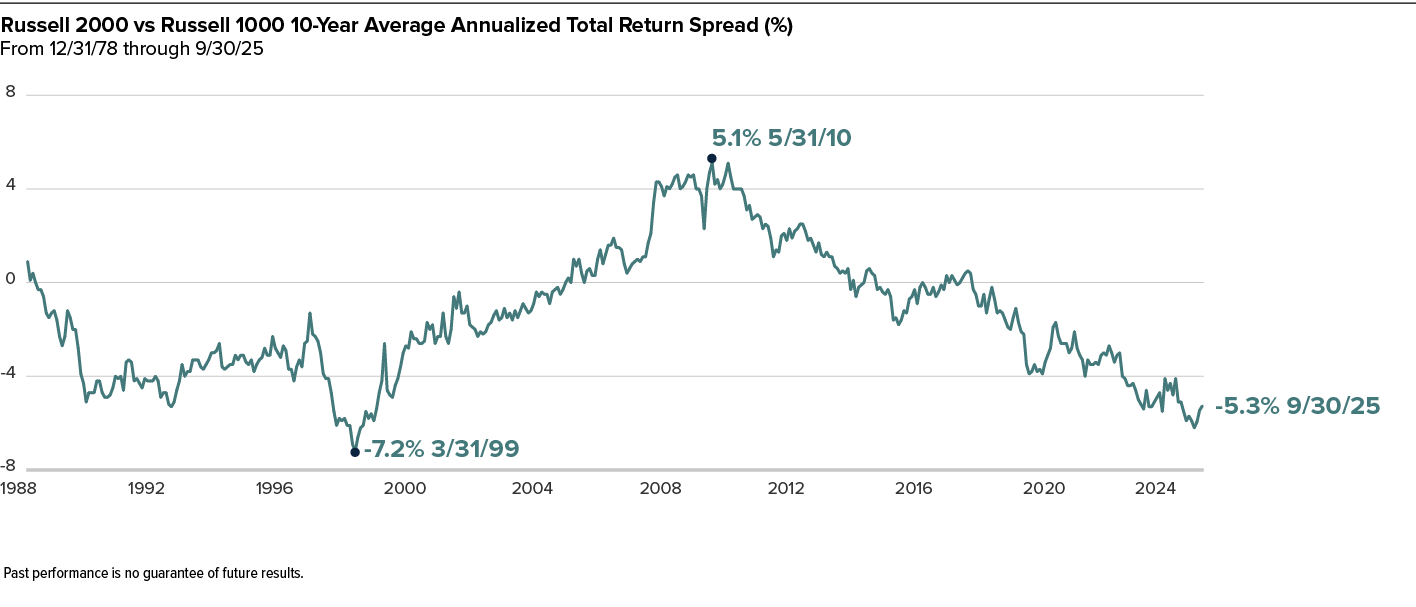

9Small-Caps Near Historic Low Versus Large-Caps

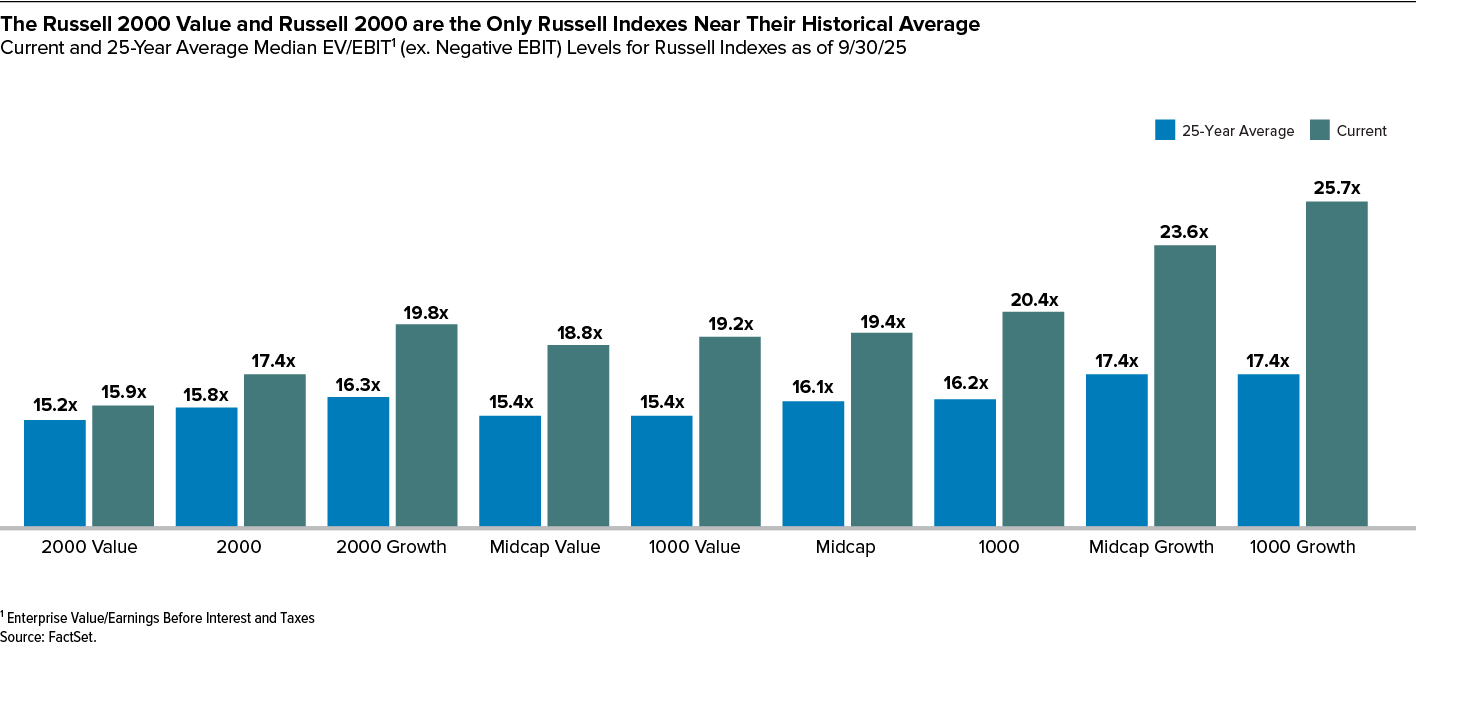

10Small-Cap Significantly Cheaper than Mid- and Large-Cap Size Segments

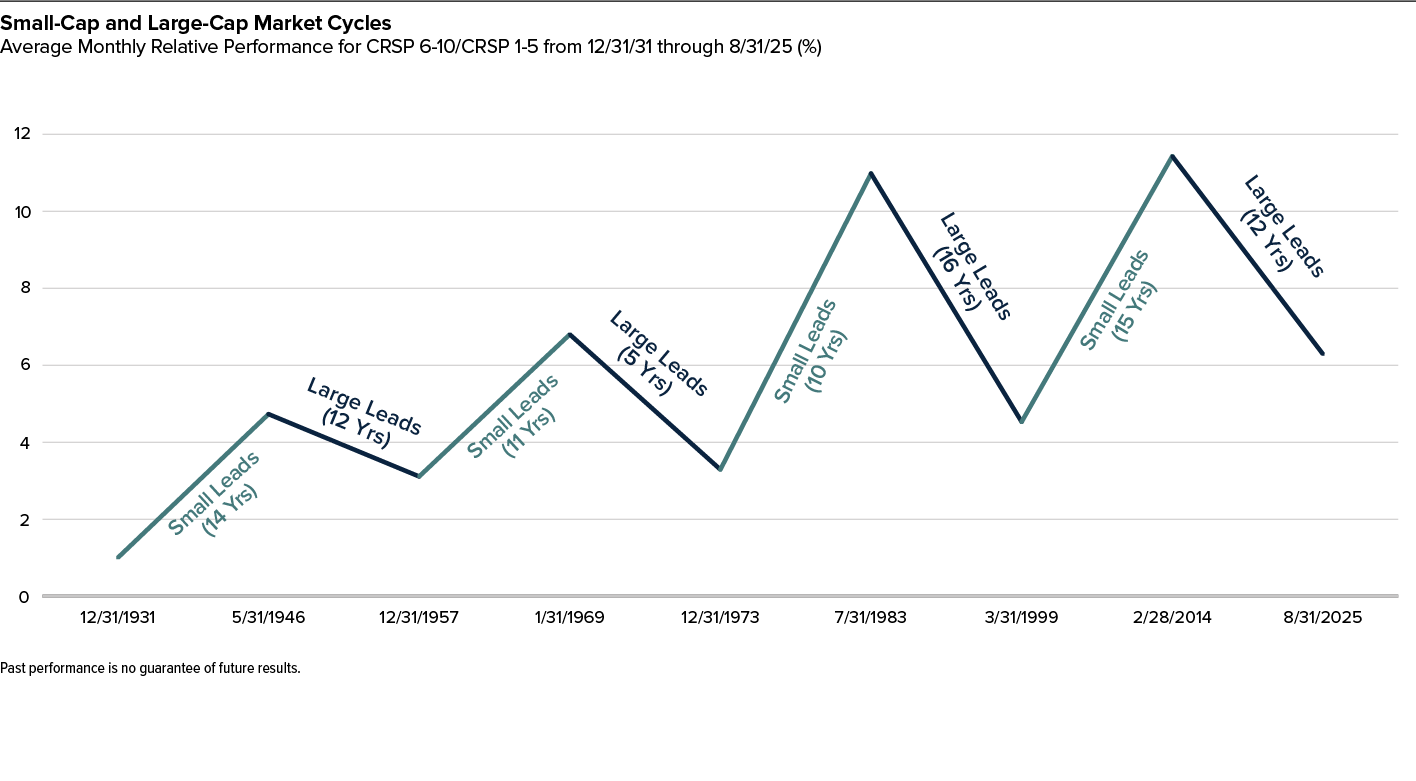

12Historically Small-Cap Cycles Have Averaged More Than a Decade

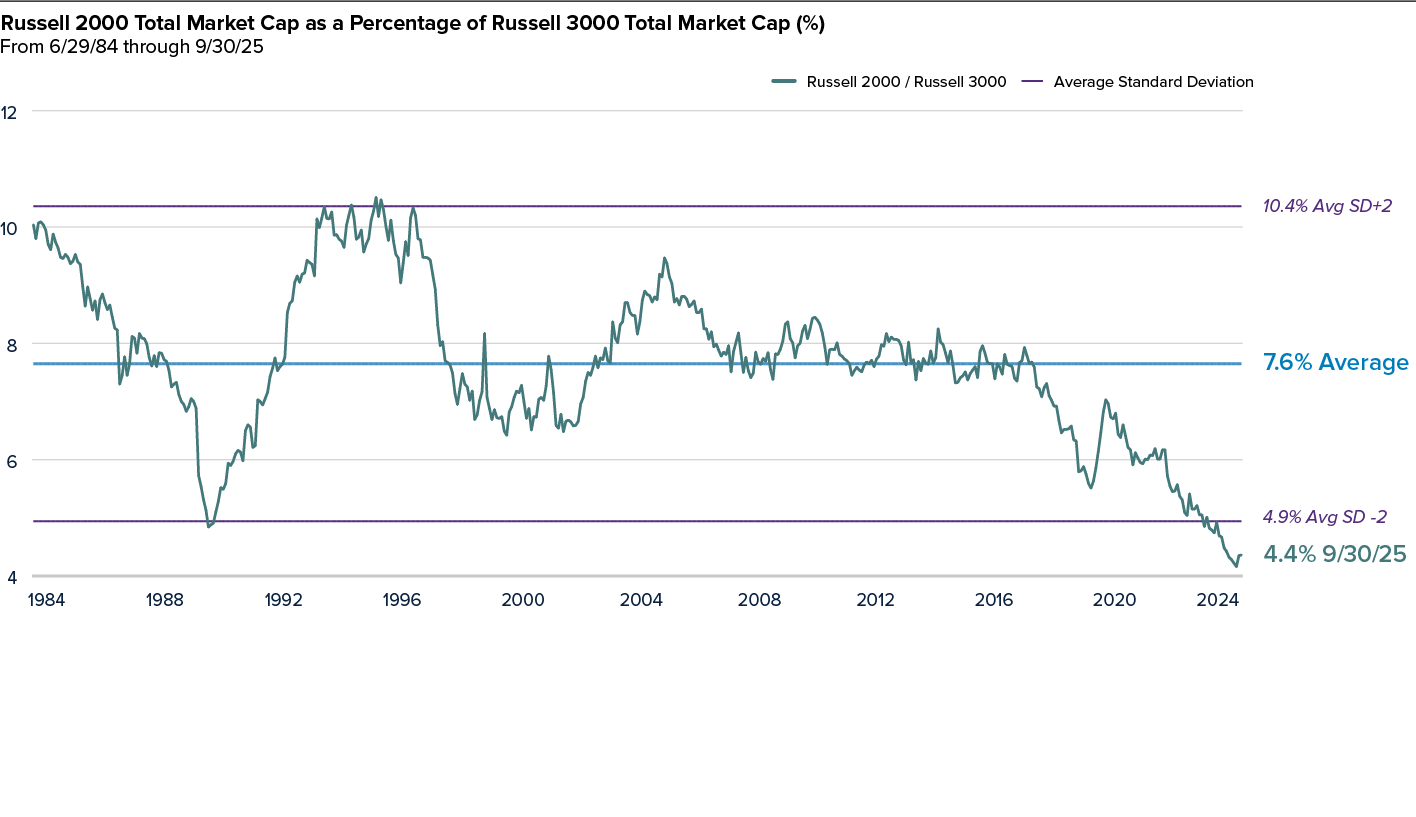

13Small-Cap’s Weight in the Russell 3000 Is Below Historical Low

14Large-Cap Cycles Peak at Market Tops Crowded with Mega-Caps

15Relative Valuations for Small-Caps vs. Large-Caps Are Still Below Average

17Small-Cap Earnings Growth—Secular Tailwinds

18Small-Cap’s Estimated Earnings Growth is Expected to Be Higher Than Large-Cap’s in 2026

19When the Equal-Weighted Russell 1000 Outperformed, Small-Cap Generally Led

20High-Quality and Low-Quality Small-Cap Stocks Have Historically Had Different Performance Profiles

Market Overview

U.S. small-cap equities ended 2025 on a stronger footing, extending the recovery that began after the sharp drawdown earlier in the year and reflecting broader market leadership beyond mega-cap stocks. Performance improved meaningfully in the second half of 2025 as investor appetite expanded toward smaller, more attractively valued companies amid easing inflation pressures and a more supportive interest rate backdrop.

For the full calendar year, small-caps participated meaningfully, though returns remained uneven across sectors, styles, and quality cohorts. Select high-growth and niche companies delivered outsized gains, while many businesses with stronger balance sheets or more cyclical exposure lagged earlier in the year before rebounding in the fourth quarter. Improving earnings trends and expectations for lower borrowing costs helped restore confidence across much of the small-cap universe.

Looking ahead, the backdrop for small-caps appears more favorable than it has in several years. Attractive relative valuations, improving breadth, and the early stages of an earnings recovery could support continued leadership, particularly if the economy continues to grow. At the same time, risks persist around earnings execution, funding conditions, and macro uncertainty. With dispersion still elevated, we believe active, fundamentals-driven strategies emphasizing balance sheet strength, sustainable margins, and consistent profitability remain well positioned in this phase of the small-cap cycle.

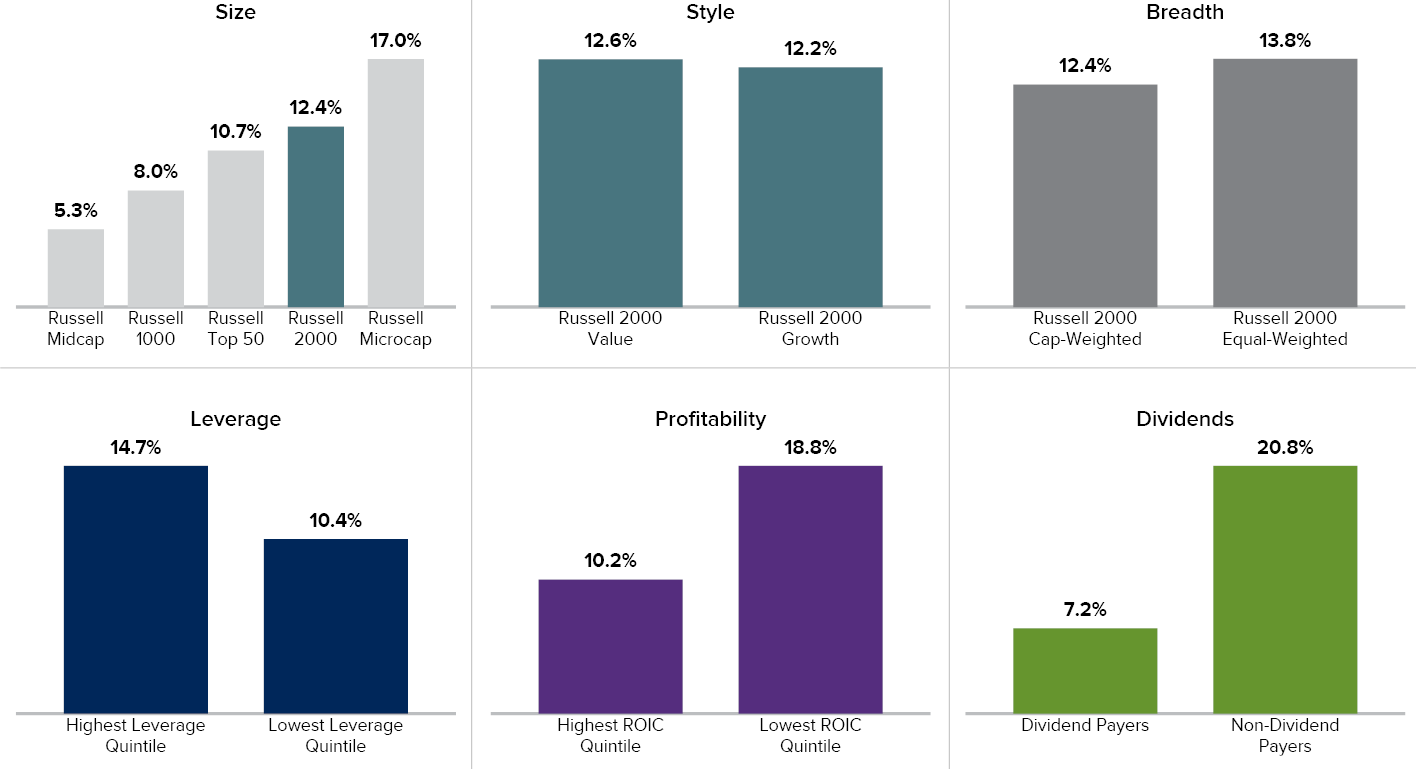

4Q25 Small-Cap Overview

The highest returns went to the smallest stocks during the fourth quarter of 2025, as smaller capitalization segments continued to benefit from a broadening of market leadership. Within the Russell 2000, small-cap value outperformed small-cap growth, while lower-leverage and higher-profitability stocks outperformed their higher-leverage and lower-profitability counterparts; dividend-paying companies lagged non-dividend payers during the quarter.

Year-to-Date Small-Cap Overview as of 12/31/25

For the year ended December 31, 2025, small-cap stocks posted solid gains but trailed large caps: the Russell 2000 rose 12.8% versus 17.4% for the Russell 1000. Within small caps, micro-caps led as investors favored smaller, more economically sensitive companies. Small-cap leadership was broadly balanced, with growth slightly ahead of value and equal-weighted results topping cap-weighted returns, signaling improving breadth. Lower-profitability and lower-leverage stocks outperformed, while dividend payers lagged.

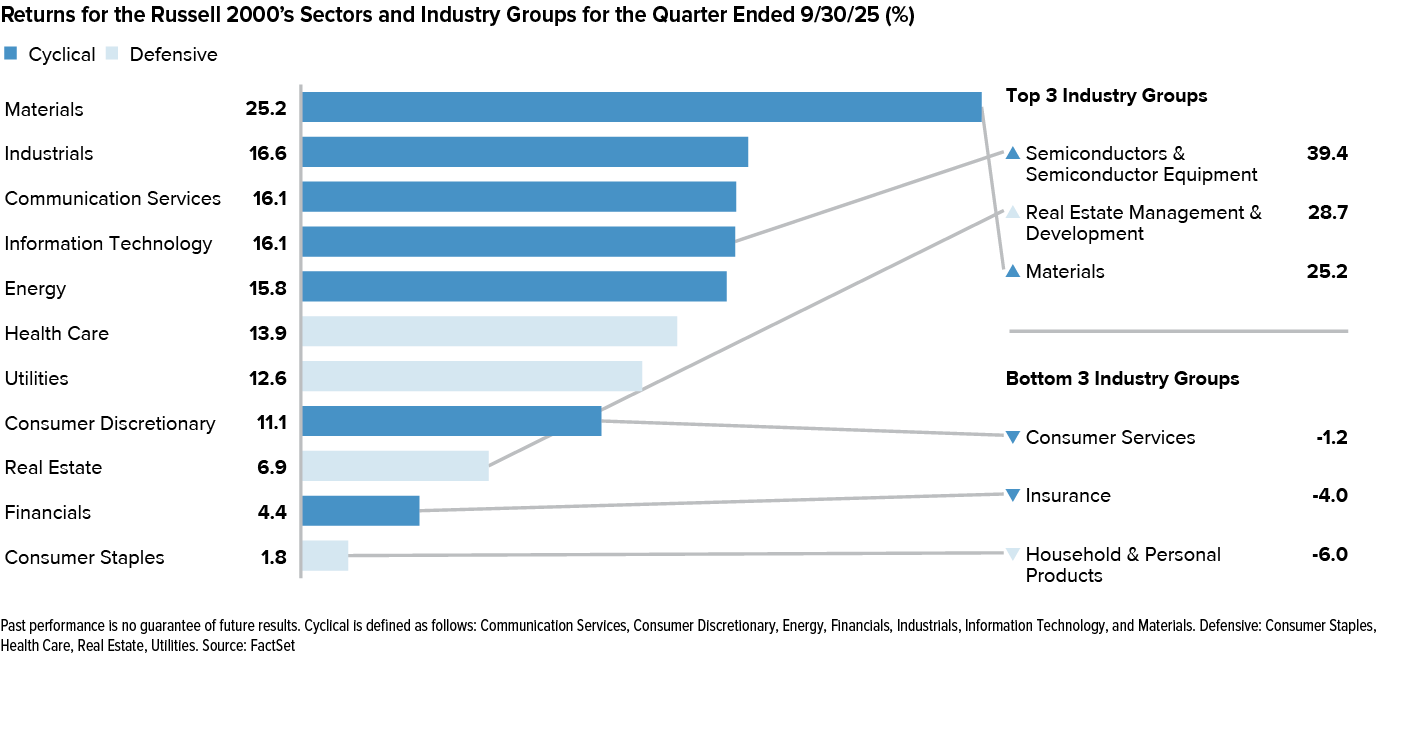

4Q25 Sector and Industry Review

Sector performance within the Russell 2000 was mixed during the fourth quarter of 2025, with Health Care delivering the strongest gains for the period, while Materials and Communication Services finished the quarter modestly higher. Together, these results reflected selective leadership rather than a broad-based rally. Five sectors finished the quarter in negative territory, including Consumer Staples, Information Technology, Consumer Discretionary, and Industrials.

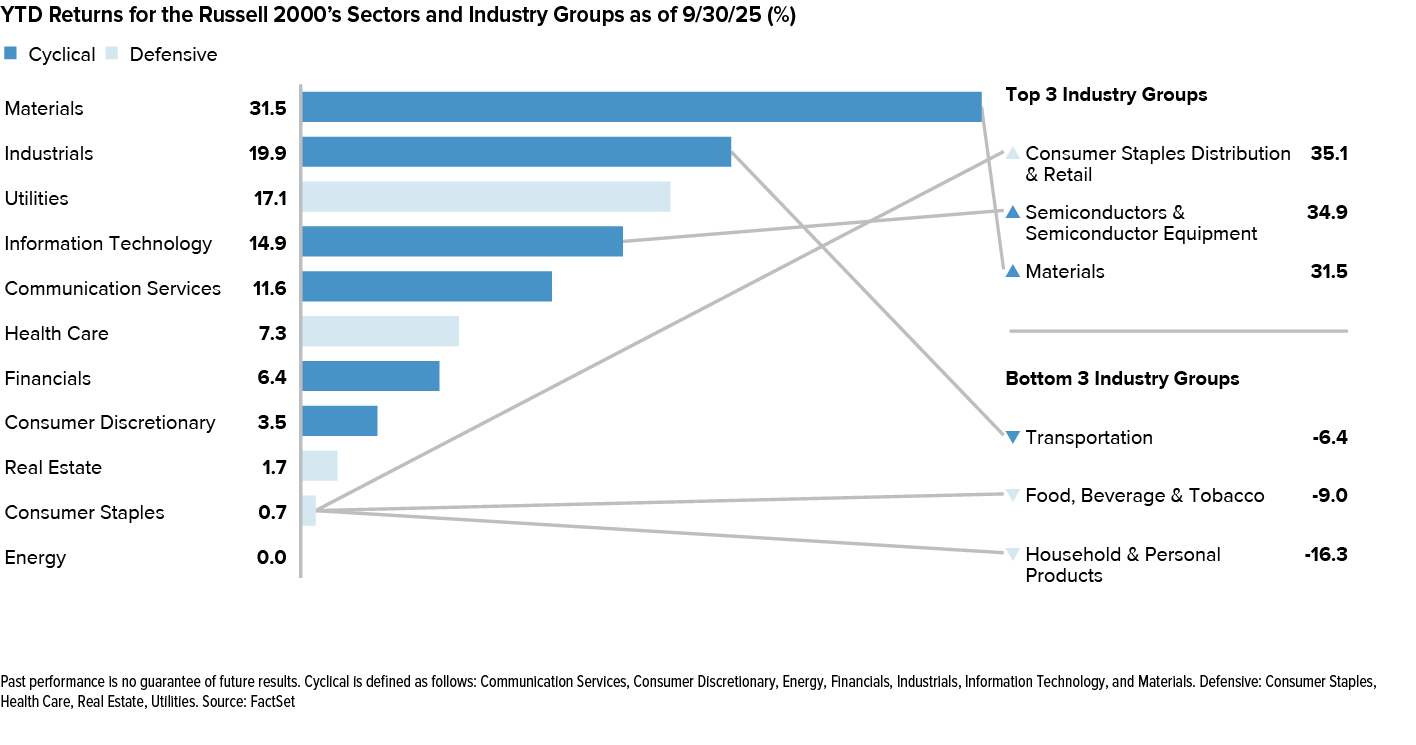

Year-to-Date Sector and Industry Review

Sector performance within the Russell 2000 was broadly positive in 2025, with six sectors finishing in positive territory. Materials was the strongest-performing sector on a year-to-date basis, followed by Health Care and Industrials, reflecting strength across both cyclical and defensively oriented growth areas. Communication Services and Utilities also posted solid gains for the year. By contrast, Consumer Staples and Consumer Discretionary finished the year in negative territory, while Energy ended the period roughly flat.

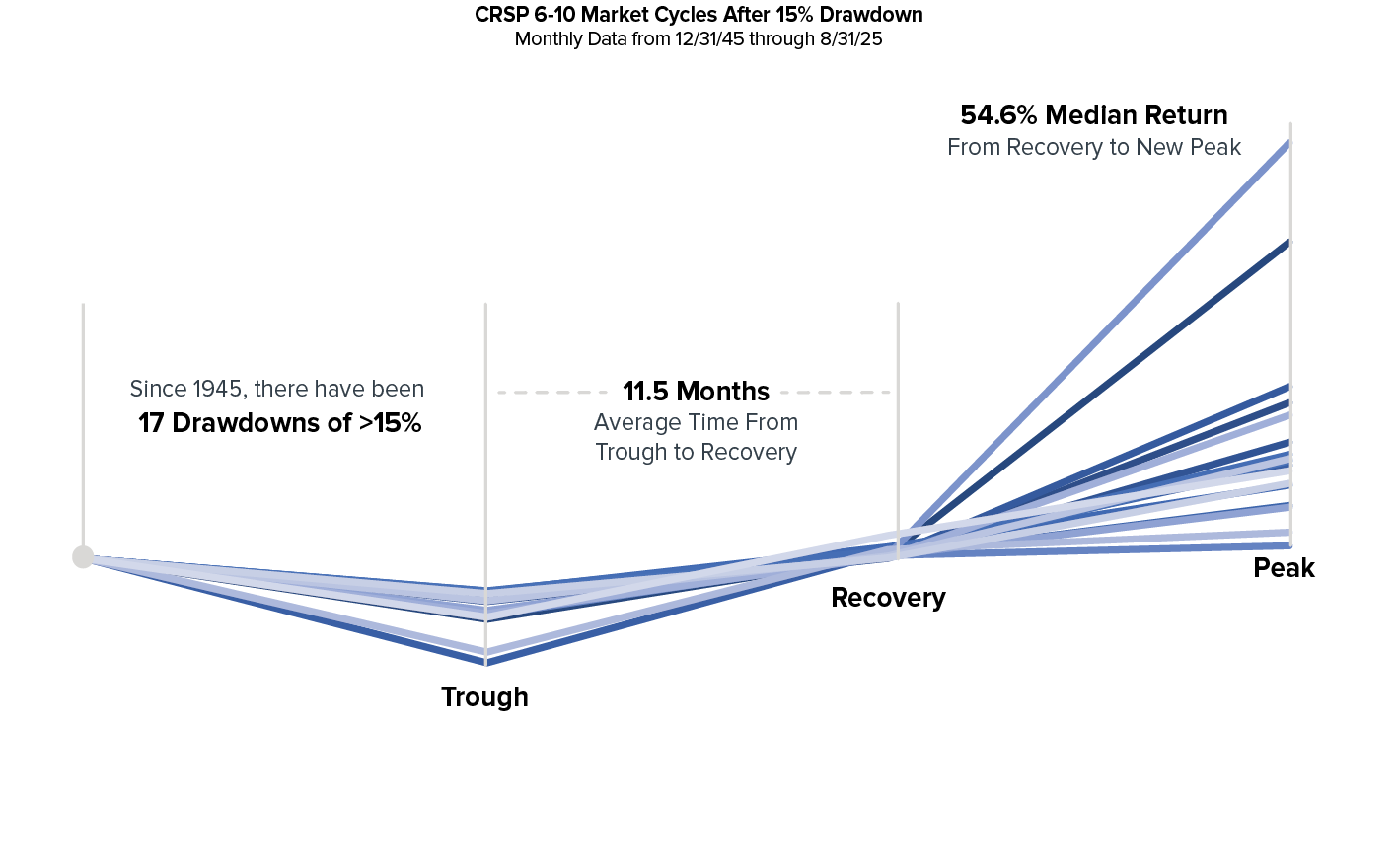

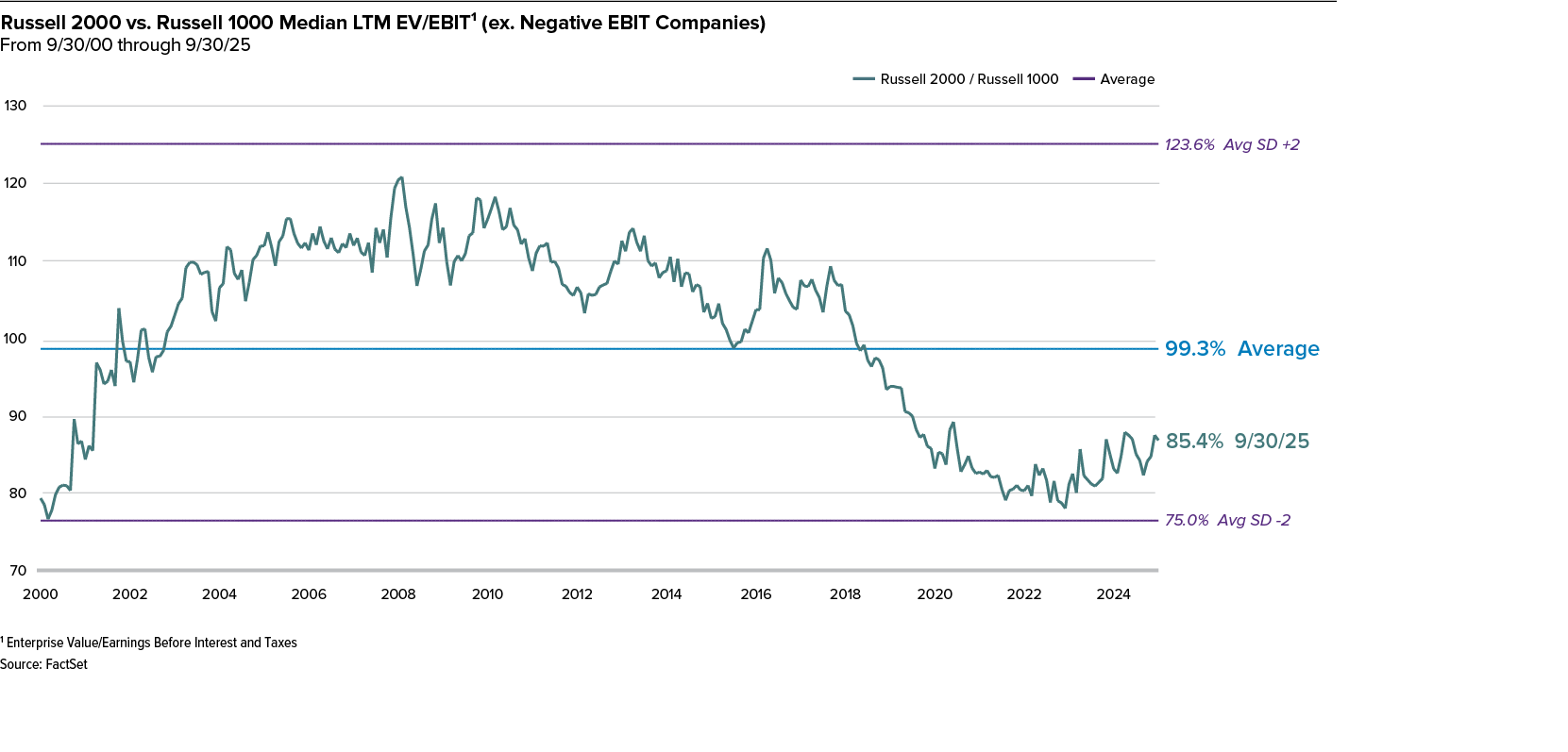

Small-Cap Recoveries Since 1945

Since 1945, small-cap stocks have historically rebounded strongly after declines of 15% or more, often leading the broader market in subsequent recoveries.

Small-Caps Near Historic Low Versus Large-Caps

Small-Cap Significantly Cheaper than Mid- and Large-Cap Size Segments

Four observations leap out when comparing various segments of the U.S. equity market as represented below by the Russell Indexes: 1) Small-Cap Value and Small-Cap Core are the cheapest segments of U.S. equities, 2) these segments are the only ones slightly above their 25-year average valuation, 3) while all three value segments (Small-Cap, Mid-Cap, and Large-Cap) have very similar 25-year average valuations, their current valuations are vastly different, and 4) Mid-Cap Growth, Large-Cap Growth, and overall Large-Cap valuations still have a long way to fall to reach their 25-year average valuations.

Historical Perspective

Elevated valuations across U.S. equities have been a recurring theme in recent years, though much of this discussion has focused on larger-cap stocks—whether the Magnificent Seven, the Nasdaq 100, or the S&P 500. In our view, small-cap stocks continue to stand apart, remaining far more reasonably valued than their larger-cap counterparts, which have captured a disproportionate share of investor attention.

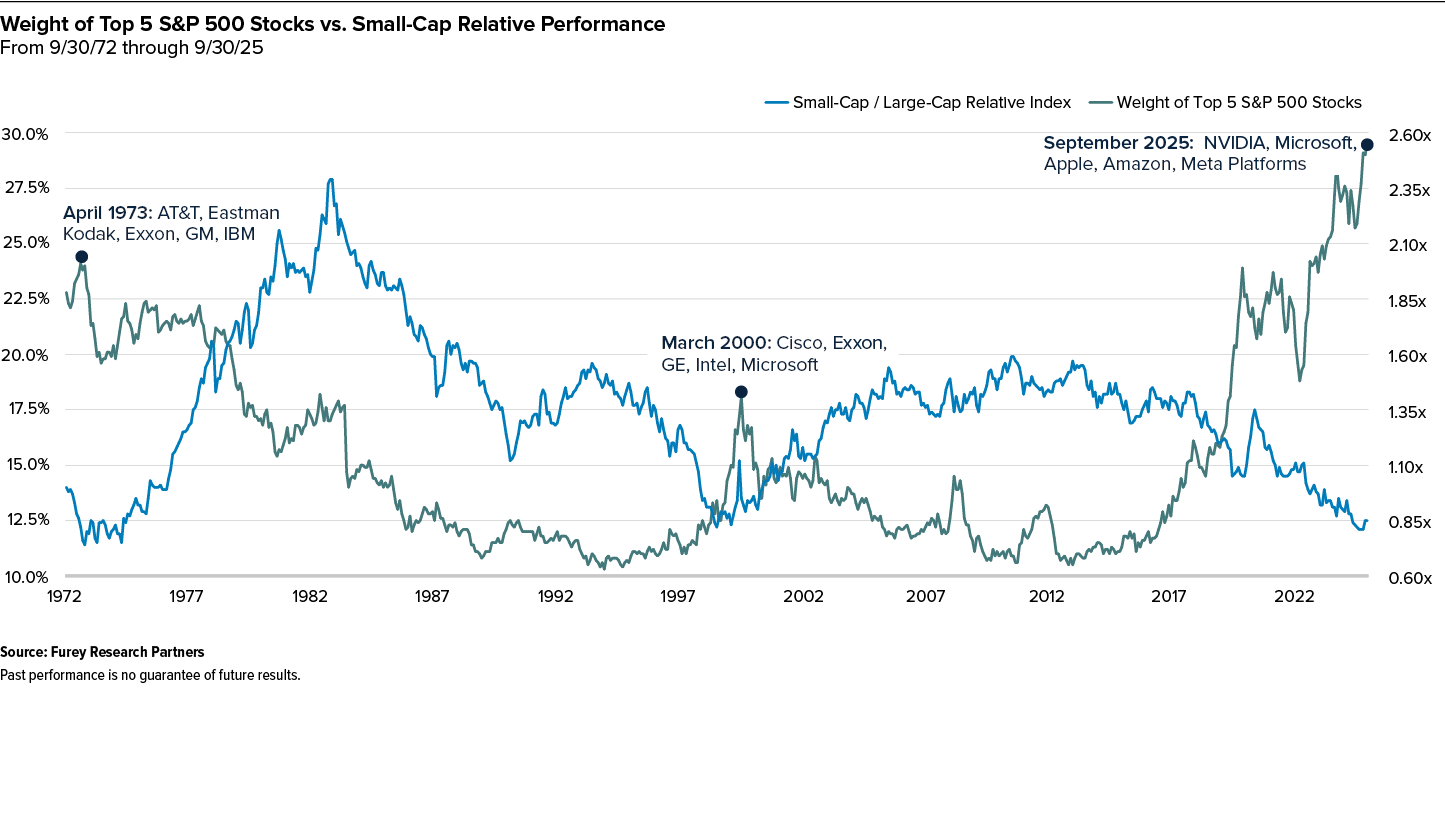

Two long-term observations help frame this valuation gap. Historically, the Russell 2000 has represented an average of approximately 7.6% of the Russell 3000’s total market capitalization. As of the end of 2025, however, small-caps accounted for roughly 4.4% of the index—well below that long-term average. In addition, based on enterprise value to earnings before interest and taxes (EV/EBIT), small-cap valuations remained meaningfully below those of large-caps, even after the recovery from the April 2025 market lows.

From a longer-term perspective, periods marked by low expectations and extended relative underperformance for small-caps have often proven to be opportune entry points. Many small-cap companies are now emerging from a multi-year earnings recession, and history suggests that missing the early stages of a recovery can carry a meaningful cost for long-term investors. Against this backdrop, we continue to see compelling opportunities among select small-cap businesses with solid fundamentals trading at attractive valuations.

Historically Small-Cap Cycles Have Averaged More Than a Decade

Secular changes in economic trends, interest rates, and monetary and fiscal policies continue to alter the long-term investment landscape. The winners under the past decade’s zero interest rate, low inflation, and low nominal growth regime will no longer lead. The unfolding macro environment points to the small-cap asset class being able to sustain, not just tactically outperform, large-cap.

Small-Cap’s Weight in the Russell 3000 Is Below Historical Low

Small-cap’s underperformance versus large-cap has reached such an extreme point that small-cap’s weight in the Russell 3000 sits at historical lows not seen since the early 1990s, another indicator suggesting that a sustained small-cap rebound may be coming.

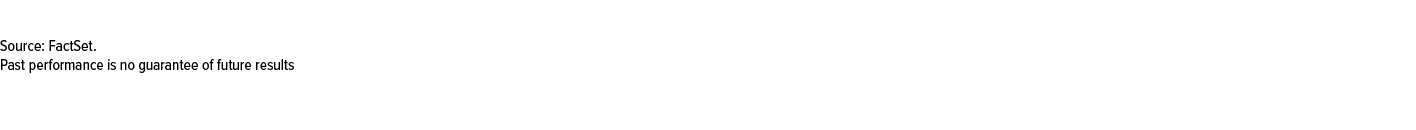

Large-Cap Cycles Peak at Market Tops Crowded with Mega-Caps

Relative Valuations for Small-Caps vs. Large-Caps Are Still Below Average

Even with the most recent outperformance, the Russell 2000 remains extremely undervalued compared to its relative valuation range over the past 25 years.

Small-Cap Market Outlook

We remain confident in the long-term prospects for U.S. small-cap equities, even as uncertainty continues to shape the near-term market environment. While macroeconomic, geopolitical, and policy risks remain elevated, both the U.S. economy and capital markets demonstrated notable resilience throughout 2025. Consumer spending has remained intact, access to capital has improved, and several structural investment themes—such as reshoring, infrastructure spending, and reindustrialization—continue to provide support for domestically oriented businesses.

At the end of 2025, small-cap stocks remained meaningfully less expensive than large-caps. Based on our preferred valuation metric, enterprise value to earnings before interest and taxes (EV/EBIT), the Russell 2000 continued to trade near the lower end of its relative valuation range versus the Russell 1000, even after the recovery from the April 2025 market lows. In addition, small-caps’ weight within the Russell 3000 remained near historical lows, reinforcing the degree to which the asset class has lagged larger companies over the past several years.

At the same time, earnings fundamentals for many small-cap companies appear to be improving. A growing number of businesses are emerging from a multi-year earnings recession, and consensus estimates point to faster earnings growth for small-caps than for large-caps looking ahead. Against this backdrop, we believe the current environment continues to offer compelling long-term opportunities for active, fundamentals-driven investors willing to navigate short-term volatility. History suggests that periods marked by low expectations and attractive relative valuations have often been favorable entry points for building small-cap exposure with a long-term horizon.

Small-Cap Earnings Growth—Secular Tailwinds

Earnings growth prospects for small-cap companies appear to be improving after a prolonged period of pressure, as many emerge from a multi-year downturn and can grow off a lower earnings base as financial conditions and fundamentals stabilize. Historically, these inflection points have often helped drive small-cap performance in the early to middle stages of market recoveries. Because small-caps are typically more domestically oriented and operationally leveraged than larger firms, improving demand, easing cost pressures, and better access to capital, alongside supportive secular and cyclical forces, can translate into outsized earnings growth over time.

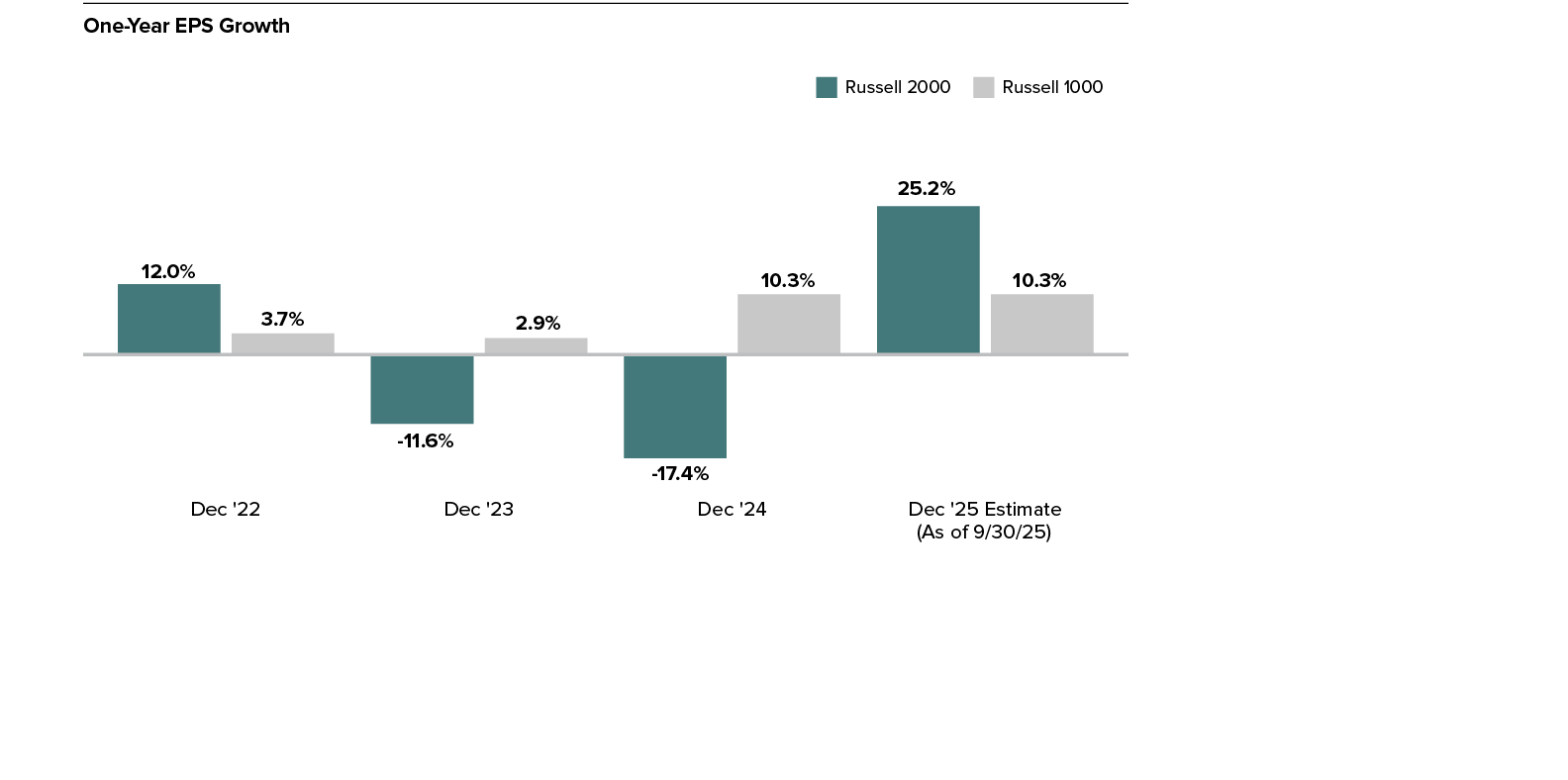

Small-Cap’s Estimated Earnings Growth is Expected to Be Higher Than Large-Cap’s in 2026

Consensus EPS estimates for the Russell 2000 are considerably higher than they are for the Russell 1000 in 2026.

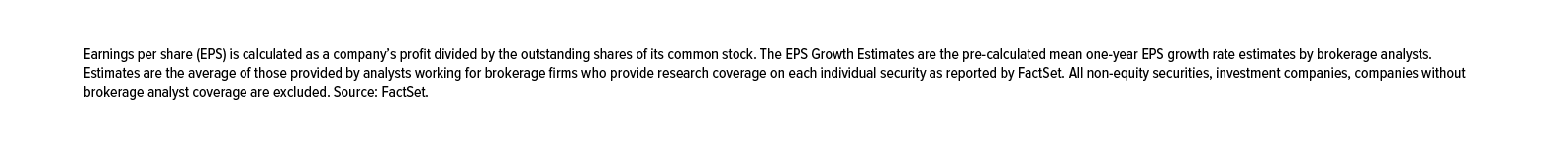

When the Equal-Weighted Russell 1000 Outperformed, Small-Cap Generally Led

Our research shows that when large-cap returns broaden, small-caps outperform. When the equal-weighted Russell 1000 beat the capitalization-weighted Russell 1000, the Russell 2000 outperformed the large-cap index over the majority of rolling 1-, 3-, and 5-year periods going back to 1984.

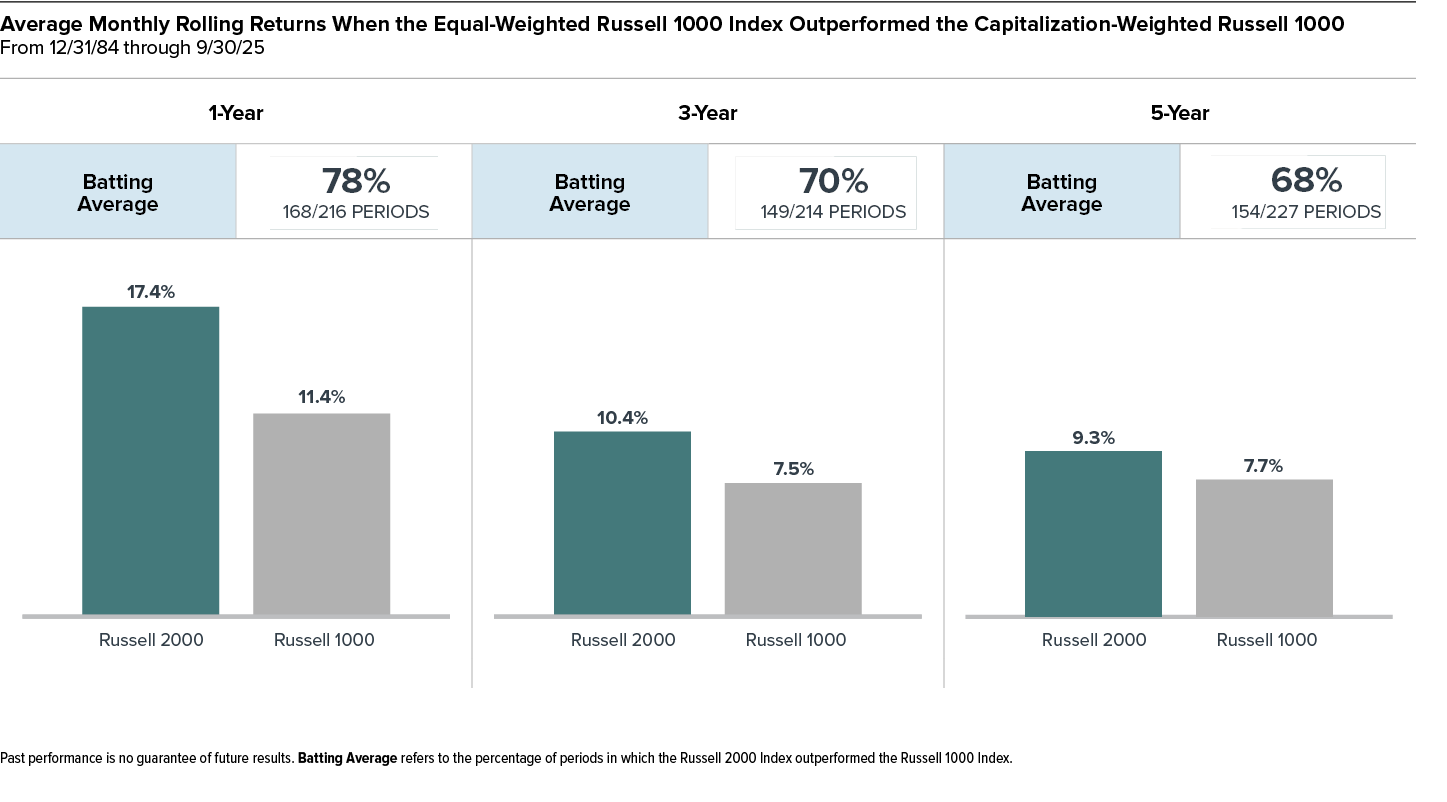

High-Quality and Low-Quality Small-Cap Stocks Have Historically Had Different Performance Profiles

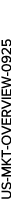

The Most Alpha Generation Potential Remains in Small-Cap

Historically, small-cap equities have offered an opportunity set for active managers because of greater dispersion, less analyst coverage, and a broader universe. As the chart shows, the Russell 2000 has produced many more stocks that doubled (or more) over subsequent 12-month periods than the Russell 1000, underscoring the depth of potential alpha in small-caps. In our view, valuations, improving earnings dynamics, and elevated dispersion create an environment for active, fundamentals-driven small-cap investing.

The performance data and trends outlined in this presentation are presented for illustrative purposes only. All performance information is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Historical market trends are not necessarily indicative of future market movements. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell 2000 Value and Growth indexes consist of the respective value and growth stocks within the Russell 2000 as determined by Russell Investments. The Russell 1000 index is an unmanaged, capitalization-weighted index of domestic large-cap stocks. It measures the performance of the 1,000 largest publicly traded U.S. companies in the Russell 3000 index. The Russell Top 50 Mega Cap Index is an unmanaged, capitalization-weighted index of domestic mega-cap stocks that measures the performance of the 50 largest publicly traded U.S. companies in the Russell 3000 index. The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. It includes approximately 800 of the smallest securities in the Russell 1000 Index. The Russell Midcap Value and Growth Indexes consist of the respective value and growth stocks within the Russell Midcap as determined by Russell Investments. The Russell 1000 index is an unmanaged, capitalization-weighted index of domestic large-cap stocks. It measures the performance of the 1,000 largest publicly traded U.S. companies in the Russell 3000 index. The Russell 1000 Value and Growth indexes consist of the respective value and growth stocks within the Russell 1000 as determined by Russell Investments. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged, capitalization-weighted index of investment grade, US dollar-denominated, fixed-rate taxable bonds. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and / or Russell ratings or underlying data and no party may rely on any Russell Indexes and / or Russell ratings and / or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. The S&P 500 is an index of U.S. large-cap stocks selected by Standard & Poor’s based on market size, liquidity, and industry grouping, among other factors, and includes reinvested dividends. The (Center for Research in Security Prices) CRSP (Center for Research in Security Pricing) equally divides the companies listed on the NYSE into 10 deciles based on market capitalization. Deciles 1-5 represent the largest domestic equity companies and Deciles 6-10 represent the smallest. CRSP then sorts all listed domestic equity companies based on these market cap ranges. By way of comparison, the CRSP 1-5 would have similar capitalization parameters to the S&P 500 and the CRSP 6-10 would have similar capitalization parameters to those of the Russell 2000. Index returns include net reinvested dividends and/or interest income. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Royce & Associates, LP, the investment advisor of The Royce Fund and Royce Capital Fund, is a limited partnership organized under the laws of Delaware. Royce & Associates, LP primarily conducts its business under the name Royce Investment Partners.

Sector and industry weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI.

Notes, Performance, and Risk Disclosure

One Madison Avenue | New York, NY 10010 | P (800) 348-1414 | www.royceinvest.com

Client Services Group | P (800) 33-ROYCE (800-337-6923)